Invest With Us

Today

How We Enable Investments?

Lily Oak uses a protocol that starts with identification of best buildings for acquisition through to the periodic distribution of investment gains

Source

We source premium deals using specific criteria to generate cashflow while positioning the property for appreciation. Typically, we go through hundreds of properties before choosing one

Purchase

After conducting property due diligence (environmental, property condition, and financial assessments), we raise debt capital and equity capital from banks and close the purchases

Manage

Maximizing property values and investor returns, ensuring tenant satisfaction, increasing income and decreasing expenses and supervision of renovations or improvements

Distribute

Processing quarterly distributions to partners, preparing financial statements for partners and for the tax seasons and, processing distributions after an exit

Interested In Investing With Us!

GET IN TOUCH NOW

We will be in touch with you within 24 hours. Talksoon!

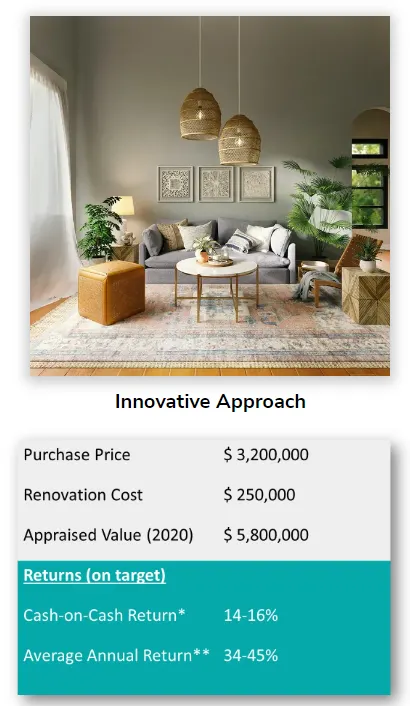

*Cash on Cash return = cash distributed to investors after all expenses are paid divided by the cash invested into the property

**Average annual return = cash on cash return plus average annual appreciation, loan pay down by tenants, and tax savings through depreciation

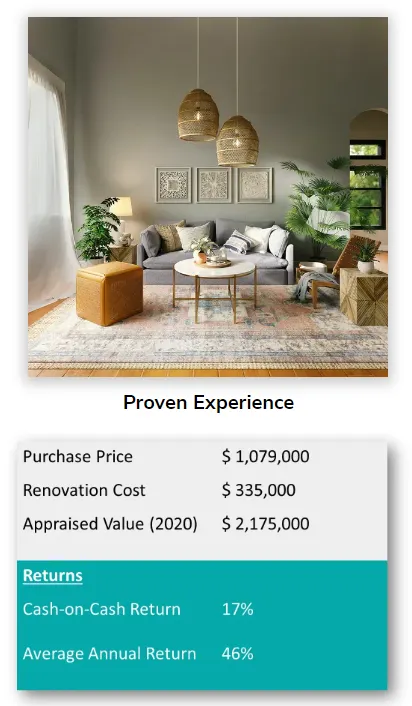

*Cash on cash return – interim cash distributed to investors after all expenses divided by the funds put into the property by the investor

**Average annual return - interim cash distributions plus distribution when property is sold after 3-5 years divided by funds put into the property by the investor

© 2025 Lily Oak - Created 100% using GrooveFunnels.com